Home > Training > Health Science Faculty (APM 671) > Report Stock/Stock Options

Report Stock / Stock Options

This article provides information on the Stock Reporting policy, the documentation required when reporting stock as well as how to report stock and provide the required documentation in UC OATS.

Stock/Stock Options Reporting Policy

In accordance with APM 671, School Implementing Procedures, and Department Compensation Plans, professional income governed by the Plan includes both cash and non-cash compensation. Faculty who receive stock or stock options in lieu of compensation for outside professional activities must disclose said options in UC OATS within 30 days of receipt of the options for review.

- If the purchase price is less than the stock/stock option’s valuation on the day of receipt, the difference between the purchase price and the value of the stock/stock options is due the Plan.

- Faculty in departments/ORUs with the alternative option for outside income, permitting them to retain income from for-profit organizations, must count this difference in their earnings threshold.

- Faculty who neglect to disclose the stock/stock options at the time of receipt will owe the Plan the difference between the initial purchase price and the market value at the time it is disclosed.

Please note: Stock that is purchased, at fair market value, as a personal investment is not considered compensation and does not need to be reported in UC OATS because it is not considered outside compensation. However, there may be conflict of issues related to a faculty’s stock ownership and any research in which they may be involved. Questions regarding these concerns should be addressed with your local campus office that manages conflict of interest compliance

Information Required when Reporting Stock/Stock Options

When reporting stock/stock options there is specific information that is required in addition to reporting in UC OATS. The following will provide you with a list of information that is required for publicly traded companies and non-publicly traded companies.

Publicly Traded Companies:

The following information must be provided at the time that the options are granted (within 30 days of receipt of options).

- A copy of all agreements between the faculty member and the company related to the consulting work and compensation;

- A copy of the offer letter or other documentation that describes the numbers of shares of stock or options that have been offered. This document should include the date(s) on which the faculty member signed the stock or stock option offer(s).

Non-Publicly Traded Companies:

The following information must be provided at the time that the options are granted (within 30 days of receipt of options).

- A copy of all fully executed agreements between the faculty member and the company related to the consulting work and compensation;

- A copy of the offer letter or other documentation that describes the numbers of shares of stock or options that have been offered. This document should include the date(s) on which the faculty member signed the stock or stock option offer(s);

- A copy of the articles of incorporation of the company;

It is required that a value can be placed on the options. Accordingly, a copy of any records the faculty member received from the company that will document the company’s stock value at the time that the faculty member originally received the stock options must be provided. This information is often found in meeting minutes of the Board of Directors or in SEC filing papers. Or, a company’s stock or stock options can also be valued by an outside attorney or accounting firm (e.g. 409a valuation report). An 83b election form can also be used, if available. - A copy of the offer letter or other documentation that describes the numbers of stocks or options that have been offered. This document should include the date(s) on which the faculty member signed the stock or stock option offer(s).

How to Report Stock/Stock Options in UC OATS

To report stock/stock options in UC OATS:

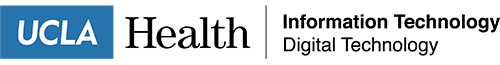

- Locate the activity in your workspace and select the Report Earnings/Effort button.

- Fill out the form.

- a) Locate the activity for which you are reporting effort.

- b) Select your remuneration type. There are several stock options to choose from.

- c) Enter the number of stock shares

- d) Enter the applicable date

- e)Enter the number of hours you engaged in the activity

- f) Enter notes about the activity

- g) Enter the start and end date of your effort

- Click on the Report button.

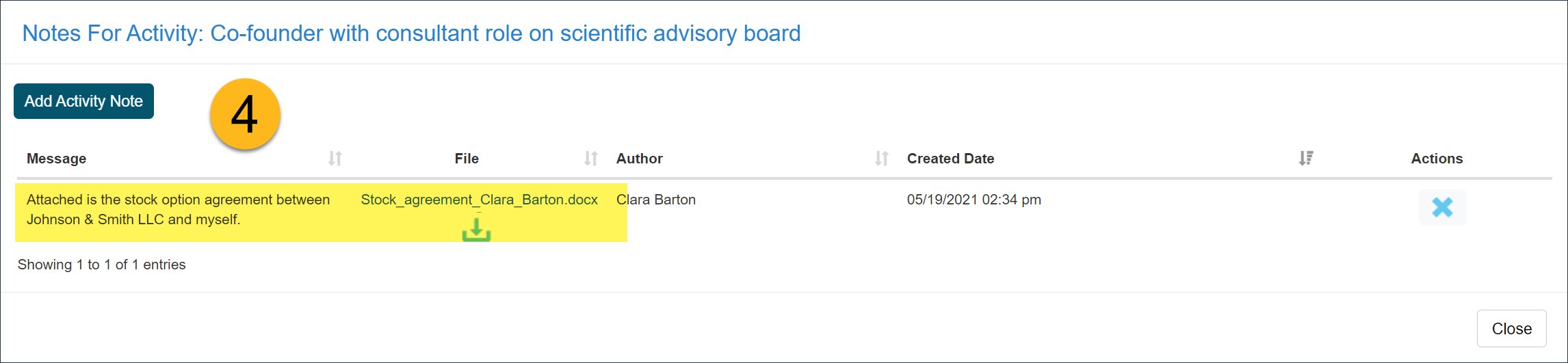

- Upload the required documentation into the activity notes field or send them via your campus's preferred method.

- Select the Show/Hide button to view or modify the effort. The time threshold bar will automatically adjust to include the reported effort.

- After reporting stock earnings, the information will be sent to a reviewer for valuation. Once the valuation is complete, you’ll receive an email notification, and you can view the valuation by clicking the View Stock Valuation button.

Related Articles

Health Science Faculty (APM 671)Edit activity details & Cat. Type

Move activity to the next fiscal year

Delete an activity

Copy activity

Report earnings/effort

Report stock/stock options

Edit/delete earnings/effort

Add notes and attachments

Campus Help Sites

UC Berkeley

UC Davis

UC Irvine

UC Los Angeles

UC Merced

UC Riverside

UC San Diego

UC San Francisco

UC Santa Barbara

UC Santa Cruz

UC OATS Portals

UC Berkeley

UC Davis

UC Irvine

UC Los Angeles

UC Merced

UC Riverside

UC San Diego

UC San Francisco

UC Santa Barbara

UC Santa Cruz

APM Policies

Academic Personnel & Programs

APM-025- General campus faculty

APM-671- Health sciences faculty

APM-240- Deans

APM-246- Faculty Administrators (100% time)

Last Modified: 2021-05-18 13:12:24.595773-07